Why Your Snow Gear Sales Might Be Slipping Even with Media Support

Introduction

Australia's snow gear market—from snowboards to ski-in/ski-out apparel—is finally showing signs of thawing. Resorts like Perisher are at full operations this season, attracting keen snowboard and ski enthusiasts SnowStash. Yet, one local outdoor brand specializing in camping equipment, hiking gear, and snow gear is puzzled: sales are continuing to drop despite heavy media and promotional investments.

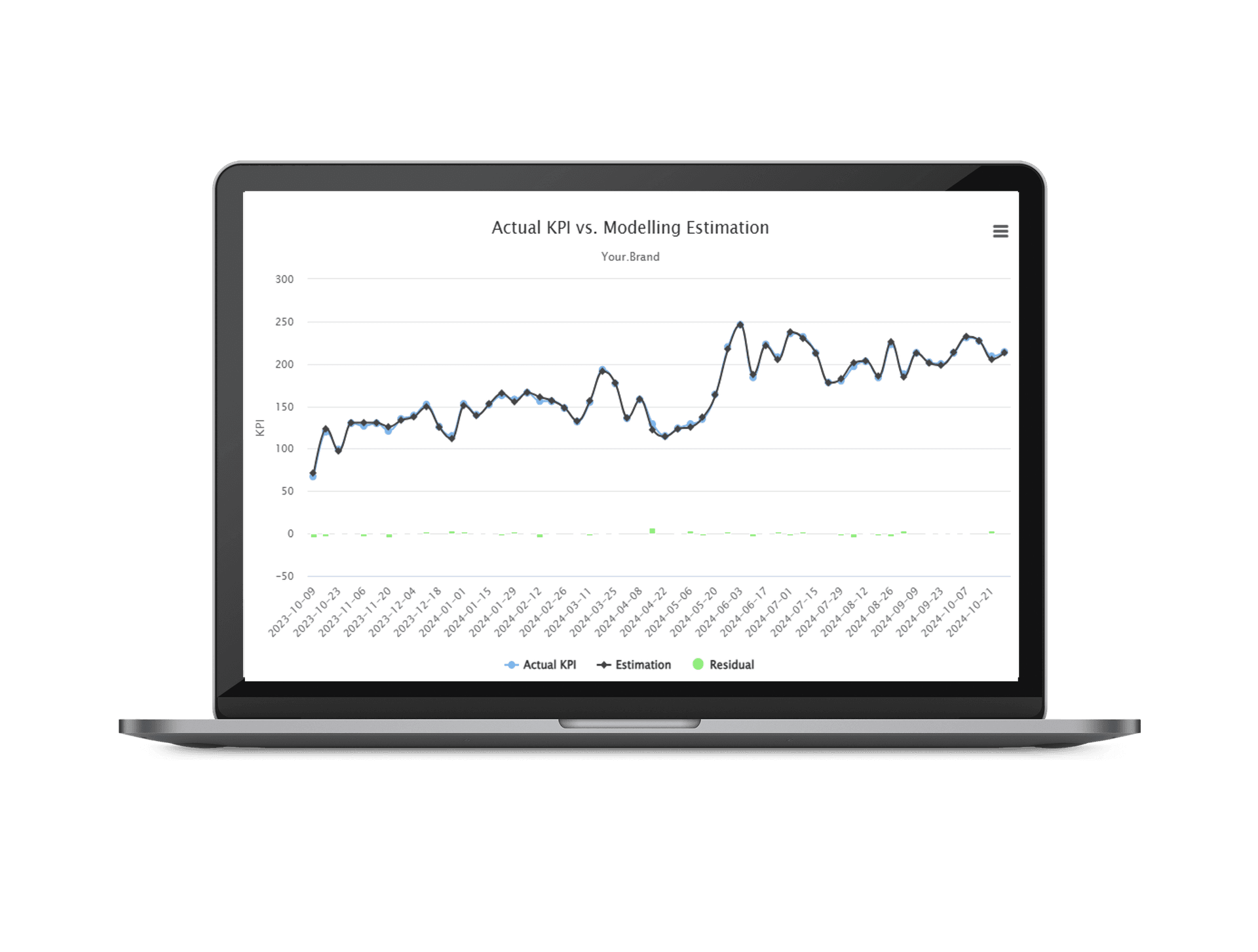

They turned to More Than Data to analyse what’s really at play. Could media, promotions, pricing changes, competition, economic pressures, or ski resort dynamics like lift tickets and nearby Airbnb be impacting sales? What emerged was a comprehensive Marketing Mix Modelling (MMM) analysis revealing how these factors interact—and what this brand must do to regain traction.

Why Use Marketing Mix Modelling?

Marketing Mix Modelling (MMM) provides analytical rigor by quantifying how media, marketing, and social-economic factors affect short-term sales. It’s perfect for seasonal products like ski gear, where marketing dollars must be precise and impact measurable.

The project focused on answering:

- Why are sales falling year-on-year?

- What roles do ATL, BTL, e-commerce, pricing, promotions, and new products play?

- Is competition intensifying channel mix erosion?

- What macroeconomic, social, and seasonal drivers are at work?

- How do ski resort ticket prices and accommodation affect purchasing decisions?

Consumers Are Becoming More Rational and Cost-Conscious

Amid economic uncertainty, rising interest rates, and living costs, discretionary purchases like snow gear are being deprioritized. Data demonstrates a marked shift toward saving over spending.

- Media narrative: Retailers such as Aldi struggled to clear seasonal snow gear, leaving many products unsold. This reflects broader consumer hesitance: 440 Percent Price Hikes Put Ski Dreams on Ice.

- Families facing mortgage pressures are opting out of luxury gear spend despite an enduring passion for winter sports. Aldi's famed "Special Buys" strategy has backfired spectacularly this season, as unsold snow gear overwhelms store shelves—transforming the typically tidy discount sections into cluttered, grim scenes of overstock: Grim scenes at Aldi as snow gear overflows Special Buys shelves.

Financial Pressures Are Suppressing Discretionary Spend

As RBA cash rates rise, household budgets tighten:

- Mortgage and loan repayments absorb higher budgets.

- Ski gear, a one-off high-cost outlay, becomes less appealing, especially when bundled with increasing ski resort expenses.

Promotions Are Less Differentiating in a Crowded Market

While promotions, discounts, and price positioning remain shopper magnets, they offer little separation when every competitor plays the same card.

- Consumers now wait for markdowns, but the shrinking buying pool and aggressive discounting dilute effectiveness.

- Brands battling over the same consumer base erode stand-alone value, pushing sales into a zero-sum game.

ATL vs BTL Media Effectiveness: A Marked Difference

The MMM revealed stark contrasts:

| Media Channel Type | Purpose | Sales Impact |

| ATL | Awareness, brand identity (TV, billboards, radio) | Low immediate sales |

| BTL | Direct conversions (paid search, social, e-commerce listings) | High, measurable ROI |

While outdoor billboards and radio spreads brand awareness, they don’t directly convert. E-commerce platforms (Amazon, eBay) and paid search are much better for true short-term sales lift.

Timing is Everything: Public and School Holidays Matter

Family snow trips drive gear purchases before peak periods like NSW’s July and August school holidays. Recent data confirms significant traffic and sales spikes tied to those dates.

- Aligning promotions with holiday triggers (e.g., “Gear up before the school holidays”) can maximize conversion opportunities.

The Perisher Deep Dive: A Critical External Driver

Ski Resort Cost Dynamics

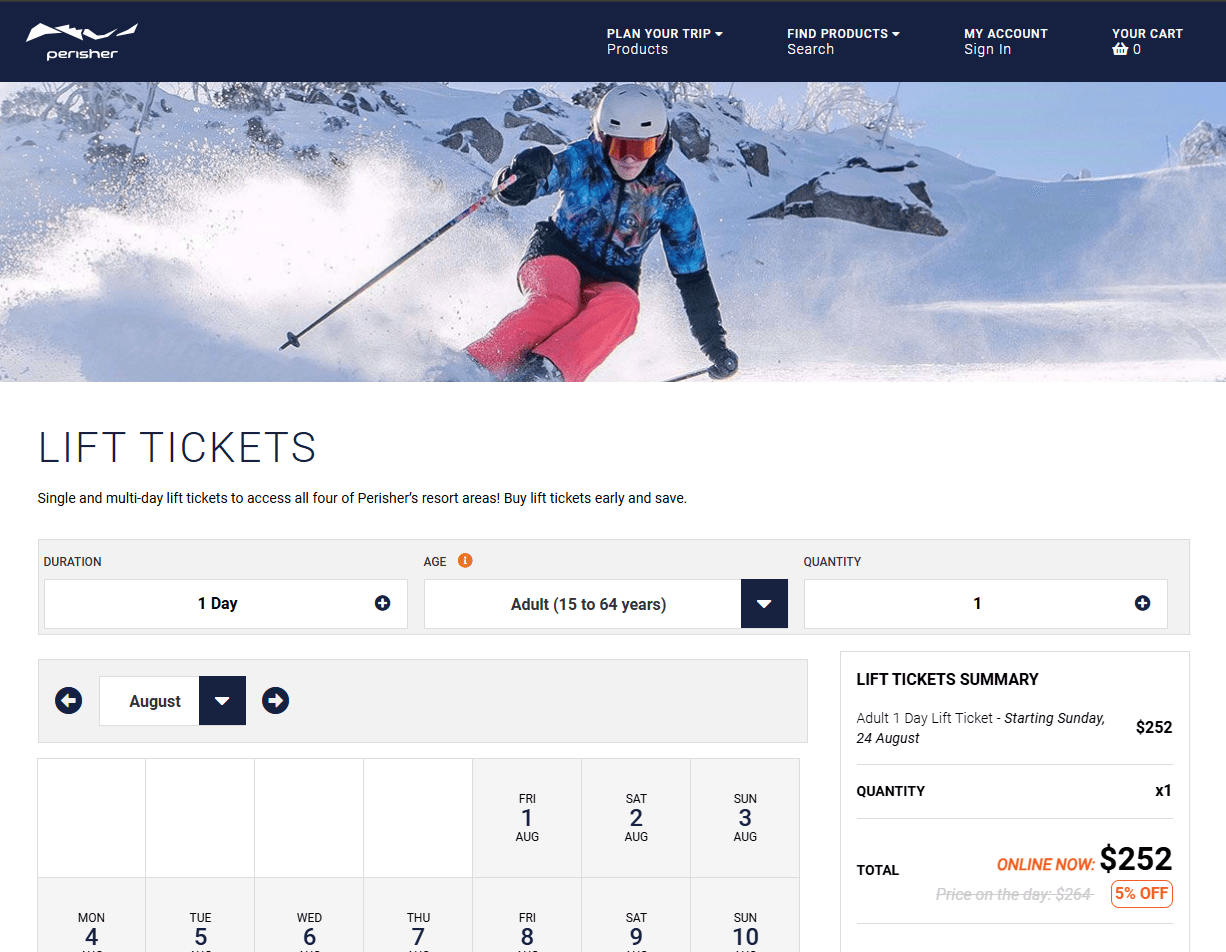

- Perisher adult day-pass prices now range from AUD $183 (advance) to up to $250 on the day.

- Lift ticket costs have surged over 441% since 1990. This major jump exercises pressure on discretionary purchases like ski gear.

Accommodation Cost and Availability

- Nearby Perisher Valley accommodations often list online for at least AUD $279 per night, even for modest hotels or lodges.

- Peak-season demand leads to rare vacancy and elevated prices—many families struggle to afford longer stays, directly limiting gear purchases.

Competitor Benchmarking Elevates the Story

When diving into domestic competitors:

| Competitor | Positioning Strategy | Observations |

| Competitor A | High-volume discount promotions in e-com channels | Gains ground but lowers margin |

| Competitor B | Premium, sustainable ski gear, higher price points | Niche appeal, limited reach |

| Competitor C | Frequent flash sales on Amazon, heavy paid search | Short wins, brand diluted |

Sales modelling indicated June and early July surge for Competitor A (pre Snow Season), while Competitor B holds consistent but low volume, indicating a loyal yet limited niche. Competitor C drives short-term e-com spikes but doesn’t convert consistently in physical retail.

Strategic Recommendations from MMM Findings

From the modelling and insights, here are both short-term and long-term tactical levers:

Reallocate Media Budget

- Shift from ATL to high-performing BTL media for immediate sales: search, social, Amazon and eBay.

- Trim billboard spend; shift ad dollars to conversion-cantered platforms.

Sync with Seasonal Demand Triggers

- Launch promotions around ski resort ticket release dates.

- Piggyback offers on school holiday calendars and weather forecasts.

Reinvent Value Messaging

- In ads, underscore product durability (e.g., “Built to last ski season after season”) over discount.

- Co-market bundled packages (gear + ticket or gear + lodging partnership), perhaps in collaboration with Jindabyne accommodations.

Differentiate Beyond Price Cuts

- Stand out via brand storytelling (e.g., Australian-made, sustainability).

- Collaborate with influencers for product visibility without racing to price parity.

Track Macro Indicators as Early Signals

- Consumer confidence, unemployment, RBA cash rate shifts—monitor these as orientation signals for planned promotions and inventory.

Conclusion

Snow gear sales are currently at a crossroads shaped by changing consumer psychology, tighter budgets, competition, and external cost pressures—especially from Perisher ski resort ticket prices and nearby accommodation coasting upward.

By leveraging Marketing Mix Modelling, More Than Data illuminated precisely which marketing levers influence sales—and which don’t. Strategic adjustments—refocusing media spend, timing promotions better, and differentiating on brand value—are the path back to growth.