Cracking the Code of OOH: How High-Resolution MMM Finally Solved the Carry-Over Mystery

Introduction: When Clients Ask the Tough Questions

It started with a phone call. You know, the kind that makes your coffee taste suddenly bitter.

Our client, a well-known alcohol FMCG brand, had one burning question:

“We spent a fortune on OOH two months ago. Where’s the laggy effect? Why can’t we see how those giant billboards are still working today? If your marketing science is as good as you say, prove it.”

Ouch. That one stung. Because honestly, they were right. Traditional Marketing Mix Modelling (MMM) had a bad habit of sweeping OOH into a single “overall” bucket. Useful for quick dashboards, sure, but useless if you actually want to know how a Sydney metro large-format billboard in February is nudging sales in March, or even April.

That was the punch in the face we needed. Instead of defending the old way, we built something new—a high-resolution modelling method designed to track, position, and measure the carry-over and time-decay effect of media spend at a granular level.

Why We Needed a New MMM Method

From Client Complaints to Innovation

Our client’s frustration wasn’t unique. Brands everywhere are asking:

- Which exact OOH placements are working?

- How long does their effect really last?

- Does a February campaign in Sydney still echo in April’s sales numbers?

It wasn’t enough to say “OOH works overall.” Clients wanted proof, broken down, geo by geo, board by board, month by month.

And frankly, if MMM couldn’t answer those questions, why call it marketing science?

The Four Big Challenges We Faced

Building a new MMM method wasn’t just flipping a switch. It came with four main hurdles.

1. Granular Data Collection

We had to track not just “OOH spend” but what kind of OOH, in which geo, and at what time. Shopping-centre ads, street furniture, large-format billboards—they all needed to be separated, labelled, and tied to sales data in matching geographies.

2. Data Processing and Labelling

Here’s where it gets tricky. It’s not enough to know an ad existed. We had to label:

- Which OOH did what

- Where it appeared

- When it ran

Without this, you’re just staring at a blurry mess of numbers that could never answer the client’s questions.

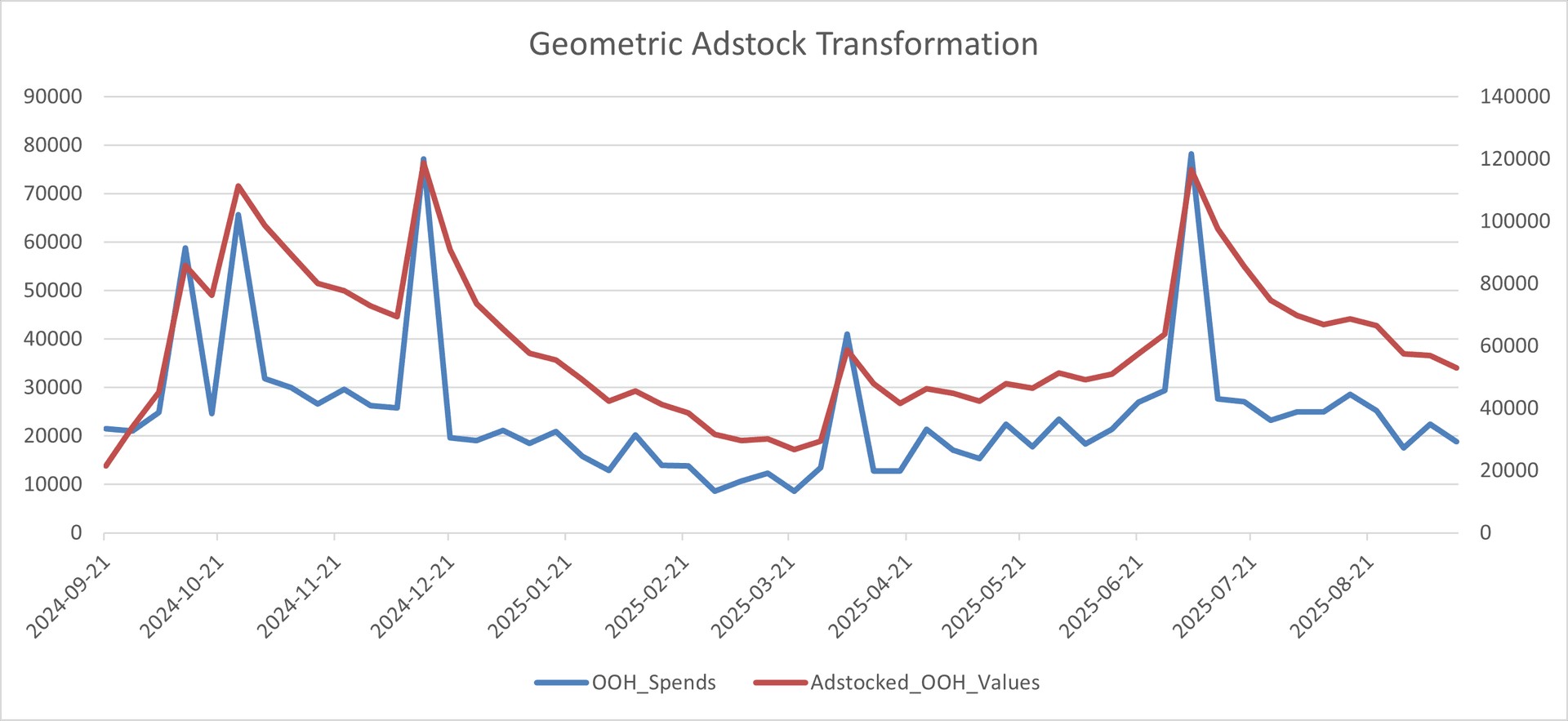

3. Adstocking Transformation

Ads don’t work like instant noodles—you don’t just “add spend and get sales.” They linger. They fade. Different channels decay at different rates.

OOH tends to hang around in people’s heads longer than, say, a digital display banner. To model this, we used adstock transformations (fancy math functions that simulate carry-over and time-decay).

The kicker? Choosing the right function and fine-tuning parameters is a lot of work. Too much manual tweaking, and you’ll lose a week of your life.

4. Constrained Modelling

Finally, we had to make sure the sum of all these new granular OOH contributions still added up to the original “total OOH” from the old model. Otherwise, clients would think we were cooking the books.

No one wants to see a Sydney billboard magically explaining 10% of national sales when its spend share was only 3%. That’s too good to be true—and we all know what happens when clients smell “too good to be true.”

Our New High-Resolution MMM Method

Here’s how More Than Data cracked it.

Step 1: Collecting and Splitting the Data

We gathered spend data by OOH type, geo, and time. Sales KPIs were split the same way. If a customer bought in Sydney, that purchase was attributed back to Sydney’s OOH campaigns—not Melbourne or Brisbane.

Step 2: Smart Data Processing

We structured the data in a wide-format table, with columns for each OOH type and spend. Add in date and geo-market columns, align them perfectly with KPIs, and voilà: we had a dataset ready for high-resolution modelling.

Step 3: High-Resolution Adstock Algorithm

Instead of manually tuning 38 OOH variables (yes, 38), we built a self-tuning adstock algorithm. It automatically adjusts decay parameters by following the sales pattern.

Result? No late-night coffee-fuelled parameter tweaking. Just clean, data-driven simulations of how long each campaign carried over.

Step 4: Constrained Modelling

We fed the adstocked data into our constrained Bayesian modelling engine. This ensured:

- Granular OOH variables added up to the total OOH share.

- Contribution shares stayed in line with spend shares.

- The math was transparent, defensible, and client-ready.

The following table displays specific OOH advertising types alongside their corresponding adstock transformation parameters. In this example, we apply a geometric adstock function with a single parameter, the decay rate. Note that different OOH types may require different decay rates, reflecting variations in carry-over and time-decay effects across ad formats.

| Media | Specific Type | Decay Rate Lower Bound | Decay Rate Higher Bound |

| OOH | Programmatic | 0.5 | 0.61 |

| OOH | Large Format | 0.72 | 0.8 |

| OOH | Retail | 0.56 | 0.67 |

| OOH | Running Boards | 0.56 | 0.67 |

| OOH | Airport | 0.63 | 0.77 |

| OOH | Digital Panel | 0.53 | 0.68 |

| OOH | Other | 0.6 | 0.7 |

| OOH | Stadium Signage | 0.67 | 0.83 |

| OOH | Street Furniture | 0.61 | 0.74 |

| OOH | Transit | 0.61 | 0.74 |

| OOH | Workplace | 0.61 | 0.74 |

Case Study: The Alcohol FMCG Brand

Let’s circle back to our client.

First, we gave them the old MMM report: one big “overall OOH” line item. They weren’t impressed.

Then, we reran the model with our new method. Suddenly, we could show:

- Sydney metro large-format OOH from February impacted March and April sales.

- Shopping-centre OOH had shorter carry-over, fading quicker.

- Street furniture played a supporting role, nudging awareness in local neighbourhoods.

The client’s reaction? Relief. Finally, they could see which placements were worth the money, and how long the effects lasted.

It wasn’t just about keeping the client happy. It was a technical breakthrough that turned frustration into innovation.

Why This Matters for the Future of MMM

High-resolution MMM isn’t just a shiny toy. It’s a survival tool.

- For brands: It answers the tough questions about spend effectiveness.

- For agencies: It builds trust and avoids those painful “why can’t you show me?” conversations.

- For MMM itself: It proves we can evolve, adapt, and stay relevant in a world demanding more transparency.

Conclusion: Punches Can Be Good for You

Getting called out by a client hurts. But sometimes, that’s the best thing that can happen.

Their questions pushed us to move beyond “overall OOH” into a world of granular, trackable, position-able media measurement.

Now, when clients ask, “Can you prove those billboards are working?”

We don’t flinch. We show them the numbers.

And if you’re ready to move past the blurry “overall” metrics into sharp, high-resolution marketing science—well, More Than Data is here for you.